Last week, The Wall Street Journal reported that the FTC and Justice Department reached a new agreement, with the FTC gaining authority to review Amazon and Facebook, while the Justice Department is able to look into Apple and Google. This deal is seen as an early step in these agencies digging into potential anti competitive practices by all four companies. These corporate behemoths, which are all among the most valuable companies in the world, are now facing a much greater threat that they'll be broken up. Facebook could be forced to get rid of Instagram and WhatsApp, Amazon might divest Zappos, and Whole Foods and Google may lose YouTube, and Apple could part with its App Store. But, let's look at the two pivotal legislation at play:

Sherman/Clayton Act:

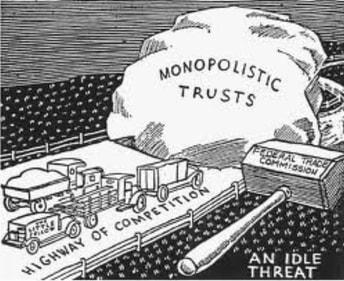

Passed in 1890, the Sherman Antitrust Act was the first major legislation passed to address oppressive business practices associated with cartels and oppressive monopolies. The Sherman Antitrust Act is a federal law prohibiting any contract, trust, or conspiracy in restraint of interstate or foreign trade. Even though the title of the act refers to trusts, the Sherman Antitrust Act actually has a much broader scope. It provides that no person shall monopolize, attempt to monopolize or conspire with another to monopolize interstate or foreign trade or commerce, regardless of the type of business. Penalties for violating the act can range from civil to criminal penalties; an individual violating these laws may be jailed for up to three years and fined up to $350,000 per violation. Corporations may be fined up to $10 million per violation. Like most laws, the Sherman Antitrust Act has been expanded by court rulings and other legislative amendments since its passage. One such amendment came in the form of the Clayton Act.

The purpose of the Clayton Act was to give more enforcement teeth to the Sherman Antitrust Act. Passed in 1914, the Clayton Act regulates general practices that may be detrimental to fair competition. Some of these general practices regulated by the Clayton Act are, exclusive dealing contracts, tying agreements, or requirement contracts; mergers and acquisitions; and interlocking directorates. The Clayton Act is enforced by the Federal Trade Commission (FTC) and the Department of Justice (DOJ). Many of the provisions of the Clayton Act set out how the FTC or DOJ can respond to violations. Other parts of the Clayton Act are designed to proactively prevent anti-trust issues.

So, with the public outcry and small startups, coupled with the "catch and kill" attitude of social media, the FTC and JD have a lot of pressure to act. Even though the FTC has allowed the mergers and acquisitions, they will have to reverse their rulings. And best of all the lobbyists on K street can't buy these agencies. My neck is at stake!

RSS Feed

RSS Feed